Discover The Best FinTech Startups

Get a list of new FinTech jobs:

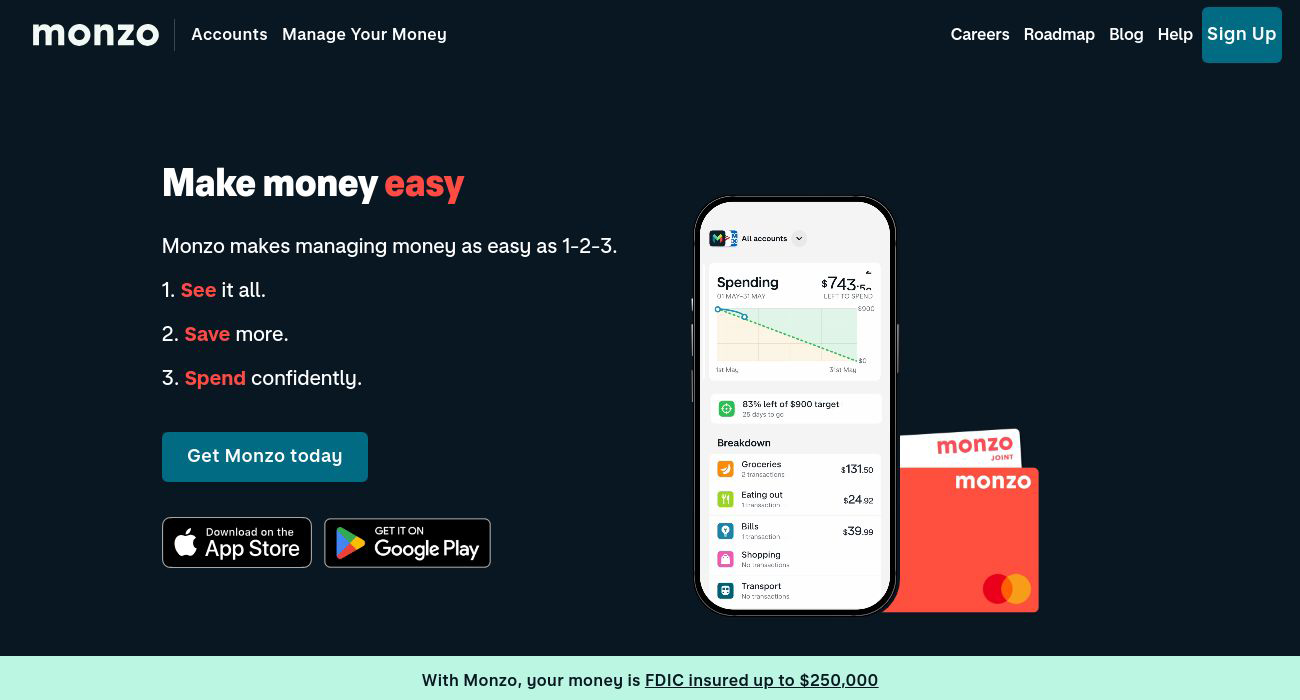

Monzo

Founded and functioning from the UK, Monzo is a fast-growing online banking provider that offers flexibility and ease-of-use for managing your money. Representing a differentiating entrant in the banking environment, Monzo serves its offerings via a smartphone application and allows users to open a full UK bank account right from their devices. This decision to exclusively deliver its services online has positioned the company as a significant player in the rapidly transforming financial landscape.

Monzo affords a range of useful financial features that extend beyond just transactions. It operates with strong emphasis on user control over their finances, with options such as 'Pots' that allow customers to organize their money as they wish. It also offers a 'Trends' feature providing an innovative view on your financial habits. Additional services include offer of white metal cards, savings and investment options, as well as 'Monzo Flex', a flexible payment option that provides interest-free payment periods. Among numerous other facilities, Monzo extends services such as international usage without extra charges, credit and overdrafts facilities, anti-fraud protection, and 24/7 support.

Choosing Monzo brings many benefits. The company is designed to deliver complete financial visibility, with your other bank accounts and credit cards integrated in one place. Its disruptive business model offers a convenient and modern alternative to traditional banking services. With over 8 million users trusting Monzo, and a host of user-friendly features and easy-to-use interface, this company can cater to your banking needs no matter the scale or requirement. It is noted for its fast service, granting full UK bank accounts in a fifteen-minute process. For anyone looking for a user-focused, intuitive, and flexible banking alternative, Monzo is undeniably a top contender in the finance world.