Discover The Best FinTech Startups

Get a list of new FinTech jobs:

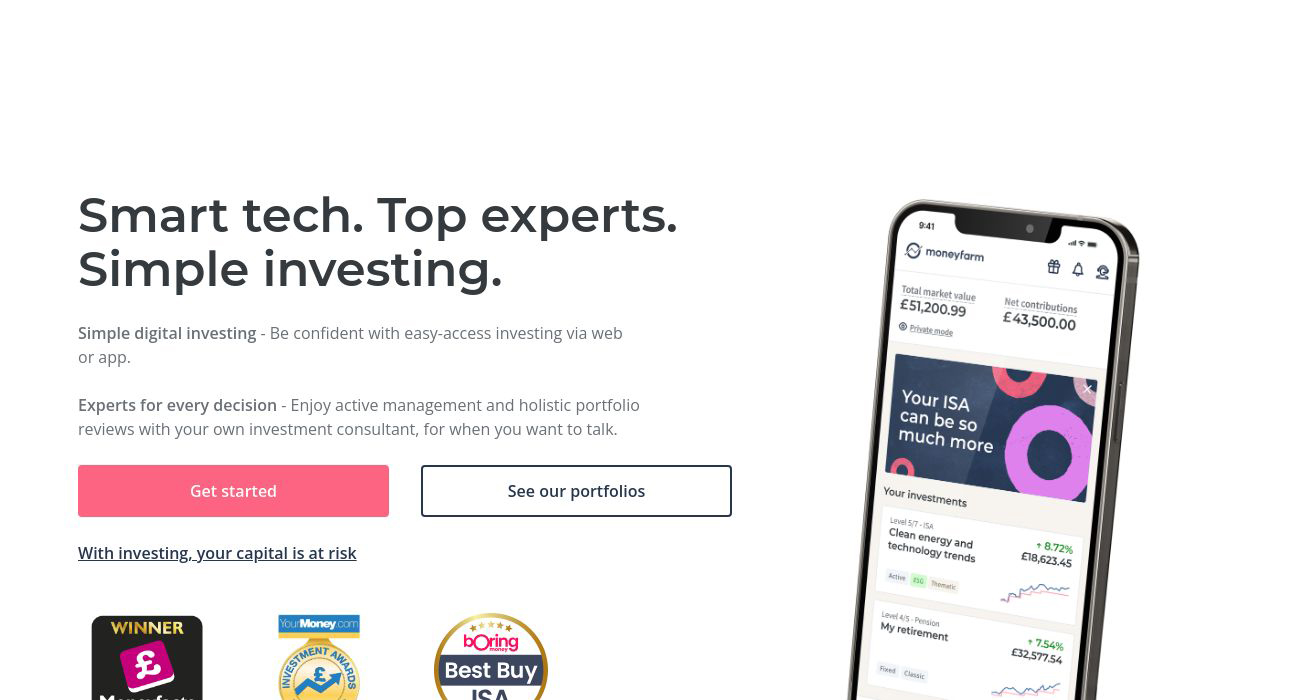

Moneyfarm

Moneyfarm UK is a wealth management firm specializing in online investment solutions. By leveraging smart technology and the expertise of industry professionals, they offer a unique and simplified approach to investing. Their primary objective is to create an accessible investing platform via web or app, allowing users to invest with confidence and receive expert advice for every decision. They provide a variety of investment solutions, including Individual Savings Account (ISA), General Investment, Pension, and Junior ISA. They are known for their active management style, environmental, social, and governance (ESG) theme investing, and flexible, transparent pricing.

Moneyfarm has catered to over 125,000 investors and has an investment portfolio of £3.5 Billion. They offer a new investment solution called Liquidity+, which promises a gross annualised yield currently above 5.2%* owing to competitive, transparent pricing. It is designed with a low-risk profile, ideal for short-term savings goals, providing users flexibility in their financial planning and an opportunity to maximise their returns. While users are primarily in control of their investments using the Moneyfarm app, the company also assures access to a dedicated consultant for complete portfolio reviews.

With flexible portfolio options, adaptable to changing investment goals, transparent pricing that decreases as your investments grow, and an expert team of managers, Moneyfarm is designed for investors at all levels of experience. It is authorised and regulated by the UK Financial Conduct Authority (FCA), adding an extra layer of trust and security for their investors. Moneyfarm’s key investors include M&G, and they hold their assets separately with Saxo Bank. Whether you're new to the world of investing or have been navigating the markets for years, Moneyfarm's innovative and secure platform is a notable choice.